Key Takeaways

- Menara Shell connects to KL Sentral’s main hub via covered NU Sentral walkway and WORQ offers flexible workspace solution at the building which helps companies to eliminate RM1-3 million in fit-out capital and reducing total occupancy costs by up to 30%

- Q Sentral sits directly above Muzium Negara MRT Station with larger floor plates (up to 40,880 sq ft) at RM5.50-7.50 psf, ideal for 100+ employee corporations needing contiguous space and 3+ year lease commitments

- Office location decision hinges on capital allocation: Q Sentral requires upfront fit-out investment (RM80-150 psf) for customization, while WORQ Menara Shell provides immediate move-in with bundled utilities, furniture, and All Access Pass to 12 transit-connected locations

Choosing between Menara Shell vs Q Sentral as your next office can shape your team’s daily experience, operational costs, and business identity for years. Both buildings sit within KL Sentral, Malaysia’s most connected business district, but they serve different tenant profiles and operational priorities.

This guide breaks down the practical differences between these two office buildings. You’ll learn about transit access, amenities, pricing structures, tenant demographics, and which building aligns with your specific business requirements.

Table of contents

- Understanding KL Sentral’s Office Building Landscape

- Menara Shell: Direct Transit Access and Flexible Workspace Solutions

- Q Sentral: Premium Grade A Specifications and Corporate Positioning

- Direct Comparison: Key Decision Factors

- KL Sentral Office Market Context

- Making Your Decision: Questions to Ask Your Team

- Why We’re at Menara Shell

Understanding KL Sentral’s Office Building Landscape

KL Sentral has transformed from a transportation terminus into Malaysia’s premier mixed-use development, housing over 65,000 office workers across 30 million square feet of commercial space. The precinct connects six rail lines (KTM Komuter, LRT Kelana Jaya, LRT Ampang, KL Monorail, KLIA Transit, and MRT Kajang) and serves more than 100,000 commuters daily.[1]

The office market in Greater Kuala Lumpur recorded an overall vacancy rate of 16.1% in Q1 2025, with distinct performance across submarkets. KL City registered 19.4% vacancy, while the KL Fringe area (which includes KL Sentral) maintained a healthier 8.5% vacancy rate.[2] This lower vacancy in the fringe area signals stronger tenant demand and more competitive leasing conditions.

Coworking spaces in KL Sentral have gained traction as corporations and startups prioritize flexibility over traditional long-term leases. According to Knight Frank’s 2025 Malaysia Real Estate Highlights, 78% of tenants now prioritize flexibility and shorter setup times when selecting office space.[3]

Menara Shell: Direct Transit Access and Flexible Workspace Solutions

Location and Connectivity

Menara Shell stands at the intersection of Jalan Tun Sambanthan and Jalan Damansara, directly connected to the MRT Muzium Negara station via a covered pedestrian bridge. This physical link eliminates weather exposure and reduces walking time for employees commuting via public transport.

The building’s position within the KL Sentral transit-oriented development (TOD) zone gives teams access to all six rail lines within a 5-minute walk. For businesses implementing hybrid work models or managing distributed teams across Klang Valley, this connectivity reduces commute-related friction and absenteeism.

Building Profile and Tenant Mix

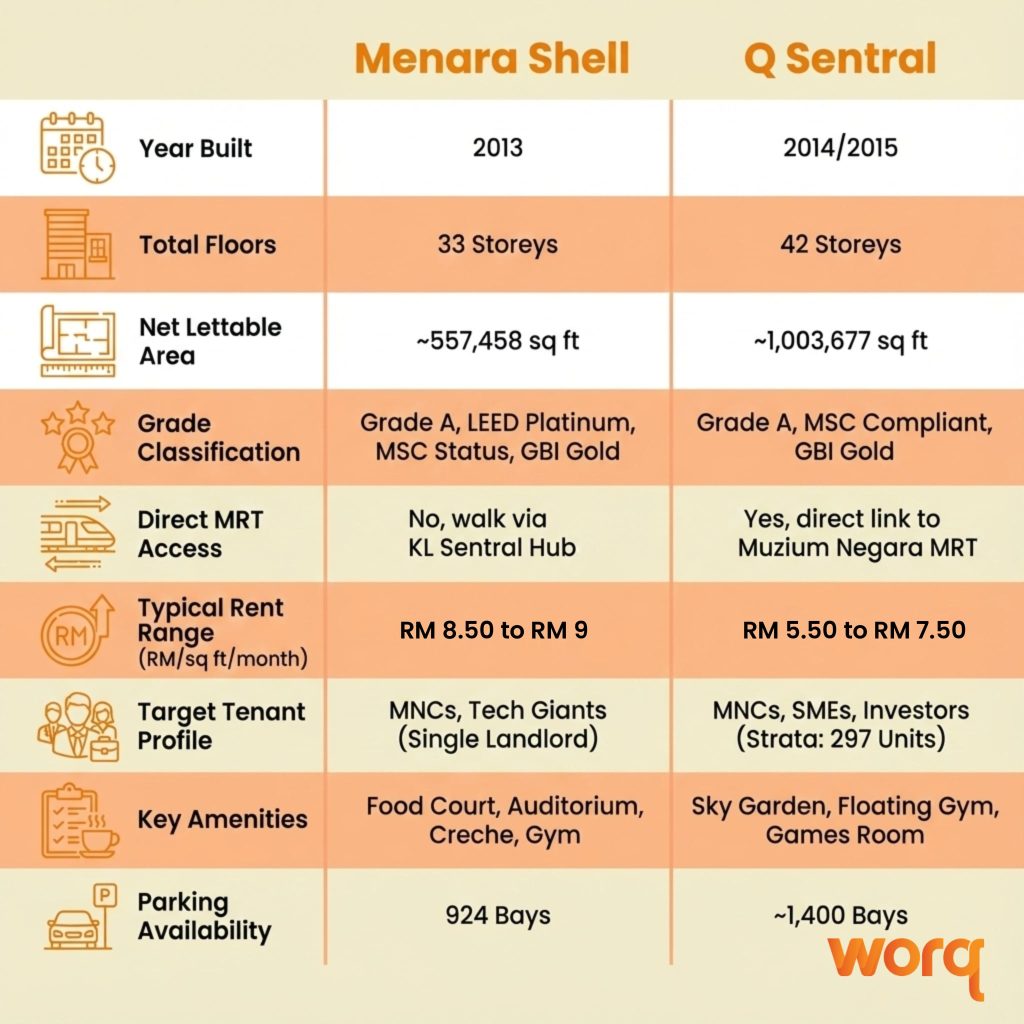

Completed in 2013, Menara Shell offers ~557,458 square feet of net lettable area across 33 floors. The building traditionally housed energy sector tenants but has diversified to include professional services firms, technology companies, and flexible workspace operator like us.

We operate a 18,000-square-foot facility at Menara Shell, offering coworking amenities including private offices, dedicated desks, meeting rooms, event spaces, and enterprise suites. The facility achieved Malaysia Digital (MD) Status and Malaysia Digital Hub (MDH) certification, signaling compliance with digital infrastructure and connectivity standards required by tech-enabled businesses.

Rental Rates and Cost Structure

Menara Shell’s asking rents range from RM8.50 to RM9 per square foot per month, depending on floor level, fit-out condition, and lease terms. This positions the building above the RM6.92 per square foot average for the broader KL Sentral CBD submarket as reported by Cushman & Wakefield in Q3 2025.[4]

For teams seeking flexible arrangements, serviced office solutions at Menara Shell can reduce occupancy costs by up to 30% compared to conventional leases when factoring in fit-out capital expenditure, furniture, IT infrastructure, and facility management overhead.[5]

Traditional leases require upfront capital for fit-out (typically RM80-150 per square foot), furniture procurement, IT cabling, and security deposits equivalent to 3-6 months’ rent. Our office cost calculator provides a detailed breakdown of initial cash outflow and total cost of ownership comparisons between conventional office rental and flexible workspace solutions.

Advantages for Specific Business Profiles

Menara Shell works well for:

- Startups and SMEs needing immediate move-in capability without capital lock-up in fit-out and furniture. The flexible workspace model allows teams to scale seating capacity monthly as headcount fluctuates.

- Distributed teams implementing hub-and-spoke models. Employees can access our network across 12 transit-connected locations throughout Klang Valley, reducing the need for fixed seating at a single location.

- Professional services firms (legal, consulting, accounting) requiring meeting room capacity that exceeds daily needs. Flexible workspace membership includes access to bookable meeting rooms and event spaces without paying for unutilized square footage.

- Companies testing the KL Sentral market before committing to long-term conventional leases. A 12-month flexible arrangement provides market intelligence and employee feedback before signing a 3+3 year lease elsewhere in the precinct.

Q Sentral: Premium Grade A Specifications and Corporate Positioning

Location and Accessibility

Q Sentral occupies a prominent position at Jalan Stesen Sentral 2, within the KL Sentral master plan area. The building sits approximately 400 meters from the main KL Sentral station concourse, accessible via covered walkways through the retail podium.

While not directly connected to a specific rail line entrance like Menara Shell, Q Sentral’s position within the KL Sentral development ensures access to all six rail lines within a 5-8 minute covered walk. The building also offers direct connectivity to NU Sentral shopping mall.

Building Profile and Premium Positioning

Completed in 2014/2015, Q Sentral represents newer construction standards with Grade A classification. The 42-story tower delivers 1.1 million square feet of net lettable area, making it one of the larger office components in the KL Sentral precinct.

The building features floor plates up to 40,000 to 40,880 square feet, accommodating larger single-tenant requirements or allowing for efficient multi-tenant floor divisions. Ceiling heights, HVAC systems, and building management systems reflect more recent engineering and sustainability standards compared to earlier KL Sentral developments.

Rental Rates and Target Tenant Profile

Q Sentral’s asking rents typically range from RM5.50 to RM7.50 per square foot per month for fitted or semi-fitted units. This premium over Menara Shell reflects newer infrastructure, Grade A classification, larger contiguous floor plates, and the building’s corporate brand positioning.

The tenant roster includes multinational corporations, financial institutions, and regional headquarters operations that prioritize address prestige and standardized global workplace specifications. Companies typically commit to 3+3 year lease terms with fit-out periods of 3-6 months before occupation.

Ideal Tenant Scenarios

Q Sentral serves businesses with these characteristics:

- Established corporations with 100+ employees requiring full-floor or multi-floor tenancies. The building’s floor plate efficiency works well for teams needing contiguous seating without structural or layout compromises.

- Multinational entities implementing global workplace standards. Newer HVAC, security, and building automation systems align with corporate real estate requirements from international parent companies.

- Financial services and professional services firms where client-facing perception matters. The Grade A specification and corporate tenant mix support brand positioning in the Malaysian market.

- Organizations with capital budgets for fit-out and furniture. Teams prepared to invest RM80-150 per square foot in customized workspace design and commit to multi-year lease terms to amortize that capital expenditure.

Direct Comparison: Key Decision Factors

Transit Connectivity and Commute Experience

Both buildings benefit from KL Sentral’s rail convergence, but the daily experience differs.

Menara Shell is connected to the main KL Sentral transit hub via a covered and sheltered pedestrian link that effectively eliminates the need for ground-level road crossings and protects commuters from weather exposure. Employees arriving via connected rail lines like the LRT or KTM can typically reach the office lift lobby within a convenient 5-to-10 minute walk after exiting the train, navigating primarily through the connected NU Sentral shopping mall.

Q Sentral offers immediate connectivity to the Muzium Negara MRT Station instead, and it is situated directly above the station. Visitors and clients can bypass the high-traffic main KL Sentral concourse and retail podium by using a dedicated, air-conditioned pedestrian link or internal building lifts (LG2), making wayfinding straightforward even for those unfamiliar with the area.

Transport Minister Anthony Loke noted that transit-oriented coworking locations can reduce employee commute time by 7,000 hours annually and cut carbon emissions by 118 tonnes per year compared to car-dependent suburban office locations.[6] This advantage applies broadly to KL Sentral but is amplified by flexible workspace like WORQ Menara Shell’s main KL Sentral transit hub connection.

Flexibility vs. Customization Trade-offs

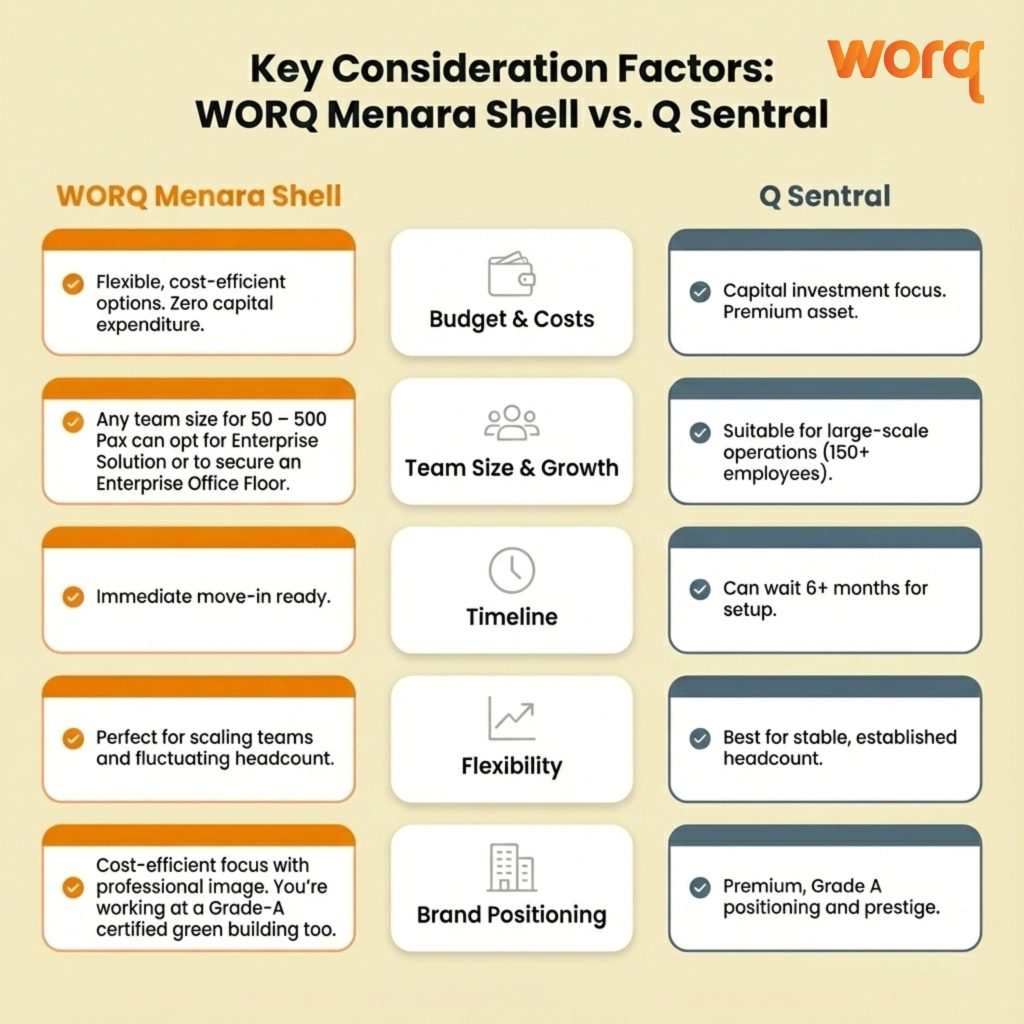

The coworking vs traditional office decision in KL Sentral often comes down to capital allocation priorities and growth uncertainty.

WORQ Menara Shell’s flexible workspace model suits teams that:

- Lack RM1-3 million in upfront fit-out capital

- Face headcount uncertainty over the next 12-24 months

- Want to test the KL Sentral market before larger commitments

- Need meeting room capacity beyond daily utilization rates

- Operate distributed teams across multiple Klang Valley locations

Q Sentral’s conventional leasing model works for organizations that:

- Have approved capital budgets for workspace customization

- Require specific layouts, branding, or security configurations not available in shared facilities

- Plan to occupy the same space for 3+ years, allowing capital cost amortization

- Need full-floor or multi-floor contiguous space (10,000+ square feet)

- Prioritize control over building systems, access protocols, and facility management

Amenity Access and Building Services

Menara Shell tenants in our flexible workspace facility access:

- 24/7 secure access with digital access control

- High-speed fiber connectivity

- Meeting rooms and event spaces (bookable online)

- Fully-stocked pantry with complimentary coffee, tea and snacks

- On-site community team for operational support

- Add-on All Access Pass enabling work from any of our 12 locations across Klang Valley

Q Sentral provides typical Grade A building services:

- Business hours reception and security (extended hours available)

- Building management system for HVAC and access control

- Retail amenities via direct mall connectivity

- Parking availability (separate lease from office space)

- Tenant customization of internal fit-out and branding

For corporate HR departments evaluating flexible office solutions, the amenity question often centers on whether built-in services reduce administrative overhead or whether direct control over facilities better serves the organization.

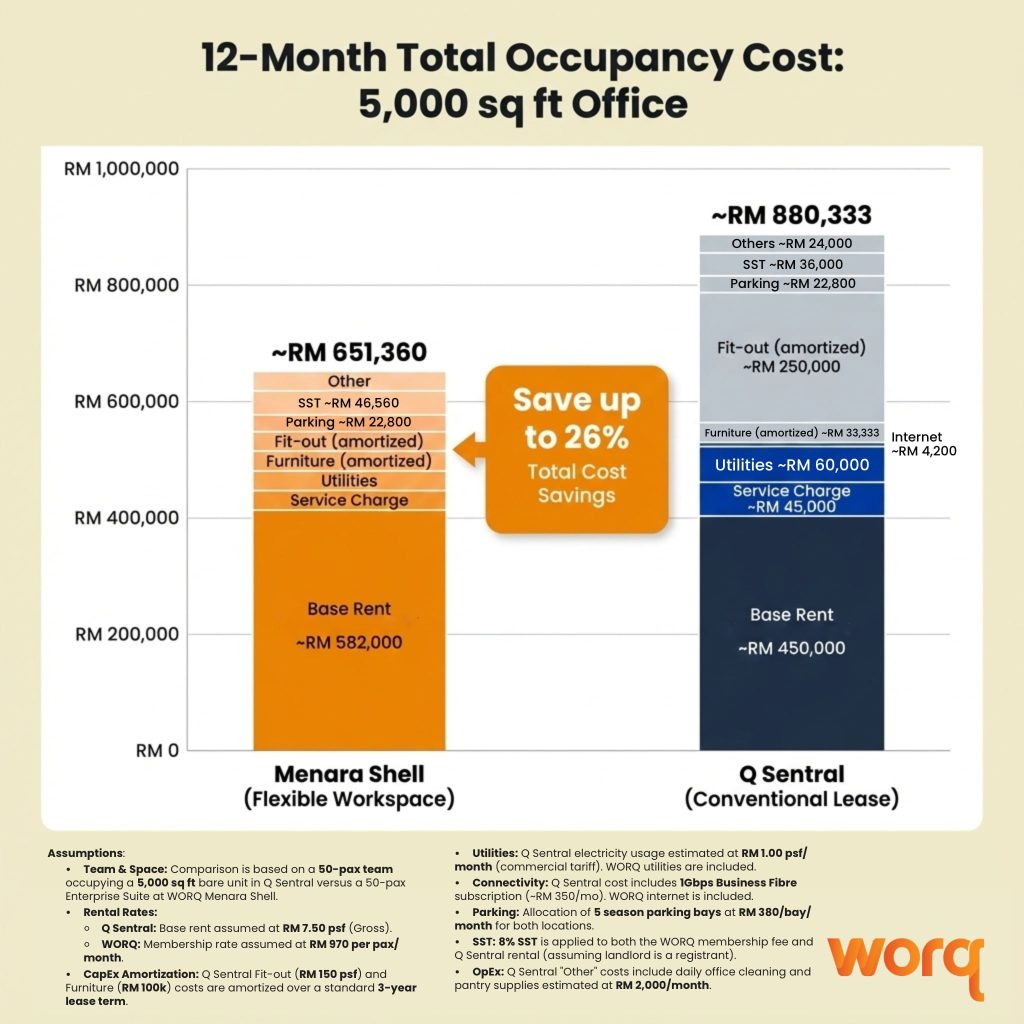

Cost Transparency and Total Occupancy Expense

Menara Shell flexible workspace pricing includes utilities, internet, furniture, meeting room credits, and facility management in a single monthly fee. This bundling simplifies budgeting and eliminates separate vendor management for internet service providers, furniture suppliers, and cleaning contractors.

Q Sentral conventional leases separate these costs. Tenants pay base rent plus service charges (typically RM1.50-2.50 per square foot per month), utilities (metered consumption), internet (separate ISP contract), parking (RM200-300 per bay per month), and fit-out capital (RM80-150 per square foot upfront).

The expanded Sales and Service Tax (SST) regime implemented in July 2025 added 8% tax on commercial rental services and 6% on construction and fit-out costs, increasing the total cost of conventional office occupation.[7] This tax structure particularly impacts Q Sentral tenants undertaking significant fit-out work.

KL Sentral Office Market Context

The broader Kuala Lumpur office market faces oversupply conditions, with 144.75 million square feet of inventory and 13.86 million square feet under construction as of Q3 2025. Overall vacancy stands at 30.16%, though this aggregates performance across diverse submarkets including the CBD, fringe areas, and decentralized locations.[7]

KL Sentral, classified within the KL Fringe submarket, significantly outperforms the market average with 8.5% vacancy compared to 19.4% in the KL City core.[8] This tighter occupancy reflects tenant preference for transit accessibility, particularly as hybrid work models make commute convenience a higher priority than corporate address prestige alone.

Knight Frank’s Prime Office Index for Q3 2025 shows KL prime office rent at RM6.02 per square foot per month, with cost competitiveness and ESG credentials sustaining occupier interest.[9] Both Menara Shell and Q Sentral benefit from this flight-to-quality dynamic, where tenants consolidate into well-located, well-managed buildings rather than pursue the lowest absolute rent in secondary locations.

Within this market context, coworking and flexible workspace solutions have emerged as a practical response to oversupply and tenant demand for operational flexibility. Greater KL now hosts approximately 700,000 square feet of coworking space across 63 locations, with roughly 200,000 square feet added annually.[10] We are expanding in KL Sentral in 2026 with our new coworking space at Menara Shell to double down on providing more coworking space options for companies.

This transit-oriented strategy addresses the core value proposition driving flexible workspace adoption: reducing friction in the daily employee experience while eliminating the capital and time required for traditional office fit-out. The cost difference between these two models becomes clear when comparing total occupancy expenses over a 12-month period.

Making Your Decision: Questions to Ask Your Team

Before committing to either building, work through these questions with your leadership team and finance stakeholders:

Budget and Capital Availability

- Do we have RM1-3 million in approved capital budget for fit-out, furniture, and IT infrastructure?

- What is our tolerance for capital lock-up in non-revenue-generating assets?

- How does our CFO prefer to structure occupancy costs (operating expense vs. capital expenditure)?

Growth and Flexibility Needs

- What is our projected headcount 12 months from now? 24 months?

- How confident are we in those projections given market conditions?

- Do we need the ability to scale seating capacity up or down with less than 3 months’ notice?

Operational Requirements

- What is our daily meeting room utilization rate vs. peak capacity needs?

- Do we operate distributed teams that would benefit from multi-location access?

- Do we need custom branding, security protocols, or layout configurations?

Employee and Client Experience

- How many employees commute via public transport vs. personal vehicles?

- Does our client base prioritize convenience or corporate address prestige?

- What is our company’s position on sustainability and carbon footprint reduction?

Timeline Constraints

- When do we need to be operational in the new space?

- Can we accommodate a 3-6 month fit-out period, or do we need immediate occupancy?

Why We’re at Menara Shell

We chose Menara Shell as one of our prime locations because it represents what modern teams need: excellent transit access, workspace flexibility, and cost transparency. The building’s location in the integrated KL Sentral hub facilitates easy commuting and helps eliminate friction. This transit-oriented design supports the ‘hub-and-spoke’ operating model we see more corporations adopting as hybrid work becomes permanent.

Our Menara Shell facility can serve 200+ member companies ranging from 2-person startups to 50-person teams. The common thread is prioritizing agility over long-term capital commitment and valuing community connection alongside professional workspace.

If your team is evaluating KL Sentral options, both buildings offer strong fundamentals. Q Sentral serves organizations ready for premium positioning and multi-year commitments. Coworking space at Menara Shell works for teams that need to be operational quickly, maintain flexibility, and allocate capital to growth rather than fit-out.

We’re here at Menara Shell. Book a tour with us and see if the space fits your team’s working style and growth plans.

Frequently Asked Questions

What is the main difference between Menara Shell and Q Sentral in terms of location within KL Sentral?

The main difference lies in their positioning relative to the KL Sentral transit hub: Q Sentral is centrally located and sits directly above the Muzium Negara MRT Station, offering the fastest access to the MRT Kajang Line via internal lifts. In contrast, Menara Shell is situated on the southwestern edge of the precinct along Jalan Tun Sambanthan and is primarily linked to the hub via a covered walkway through the NU Sentral shopping mall. While both buildings provide sheltered access to the major rail lines (LRT, KTM, ERL), Q Sentral is closer to the MRT entrance, whereas Menara Shell typically requires a 5-to-10 minute walk to reach the main station platforms.

Which building offers better value for money for a 20-person team?

For a 20-person team, Menara Shell typically delivers better value through flexible workspace solutions through WORQ coworking space that eliminate upfront fit-out capital, reduce total occupancy costs by up to 30%, and provide scaling flexibility as headcount changes. Q Sentral works better if you have approved capital budget, need custom layout or branding, and plan to occupy the same space for 3+ years to amortize fit-out costs.

How do the rental rates compare between Menara Shell and Q Sentral?

Menara Shell commands premium rental rates of RM 8.00 to RM 9.00 psf as of 2025, reflecting its status as a single-owner, LEED Platinum, and MSC-certified Grade A tower. In comparison, Q Sentral offers more varied rates, typically averaging RM 5.50 to RM 7.50 psf, due to its stratified ownership structure. WORQ Menara Shell is revitalizing the market by providing a “Space-as-a-Service” coworking space model that eliminates high upfront fit-out costs (which can reach RM 200-400 psf in traditional leases) and offers all-inclusive, predictable monthly pricing. This allows companies to secure a prestigious corporate address with flexible lease terms, enabling them to scale their footprint rapidly or adopt a “hub-and-spoke” model across WORQ’s transit-connected network.

Can a company lease an entire floor at Menara Shell like they could at Q Sentral?

Yes, Menara Shell offers both flexible workspace solutions and conventional full-floor leases. However, Q Sentral’s larger floor plates make it more suitable for organizations needing 100+ contiguous seats on a single floor. For teams under 50 people, Menara Shell’s flexible workspace model via WORQ often provides better efficiency and cost structure.

What are the parking options and costs at both buildings?

In 2025, while both buildings support full-floor leasing, Menara Shell offers cohesive Grade A floor plates of 14,000–18,000 sq ft under single ownership, whereas Q Sentral provides larger stratified floors up to 40,000 sq ft. For a more streamlined approach, WORQ’s Enterprise Solution offers a high-value alternative to traditional leasing by eliminating massive upfront fit-out costs (CapEx) and providing fully customized, brand-integrated offices. Key USPs include operational agility through flexible lease terms, all-inclusive management of utilities and IT into a single monthly bill, and the unique benefit of global network access, allowing employees to utilize any of WORQ’s 12+ transit-connected locations across the Klang Valley.